Let’s talk about tax cuts in general, and the Utah legislature’s 2024 tax cut specifically. The Utah legislature has cut income taxes for four years in a row. This year’s income tax cut totals about $167 million. [fn 1]

Utah has a flat tax rate. No tax brackets, and the tax rate is the same for individuals as it is for companies. Everyone pays the same percentage of income tax. Currently, the tax rate is 4.65% of taxable income. The new tax cut of 0.1% will change that to 4.55% of taxable income. A tax cut of 0.1% is not going to help out anyone who is struggling financially, and it’s really not much money for people and companies who are already rich. Let’s look at some examples.

Let’s use an ideal LDS family of five. Dad works at a great job that pays him a taxable income of $100,000 (so this isn’t gross income; this is income after tax deductions); Mom’s a SAHM; three kids at home. This tax cut will put an extra $100 in their pockets. That pays for half a week of groceries (give or take). They pay sales tax on the groceries they buy. Utah is one of 13 states that still taxes food, and the tax rate is 7% to 9% depending on which city/county you’re in.

Let’s look at a family that is less well off. Say Dad’s taxable income is $48,000 instead. The family gets a tax cut of $48. On a good day, that might be a tank of gas. [fn 2] Spread over 12 months, that tax cut is $4 per month and probably the family won’t even notice the tax cut.

Let’s look at a rich person who has $5,000,000 of taxable income. Like the vast majority of rich people (who don’t get into the news), Rich inherited his wealth [fn 3]. With this 0.1% tax cut, Rich is going to pocket an extra $5,000. He puts it in a bank account. With $5,000,000 of spending money annually, that $5,000 isn’t necessary for living expenses. Rich doesn’t pay any sales tax because he doesn’t need to spend his $5,000 tax cut.

Same numbers for companies. A company takes its gross revenue and deducts all of its business expenses, like salaries, utility payments, cost of goods sold, everything it takes to run the company. If Company has taxable income of $100,000 then this tax cut gives Company an extra $100. If Company has taxable income of $5,000,000 then this tax cut lowers the Company’s tax bill by $5,000.

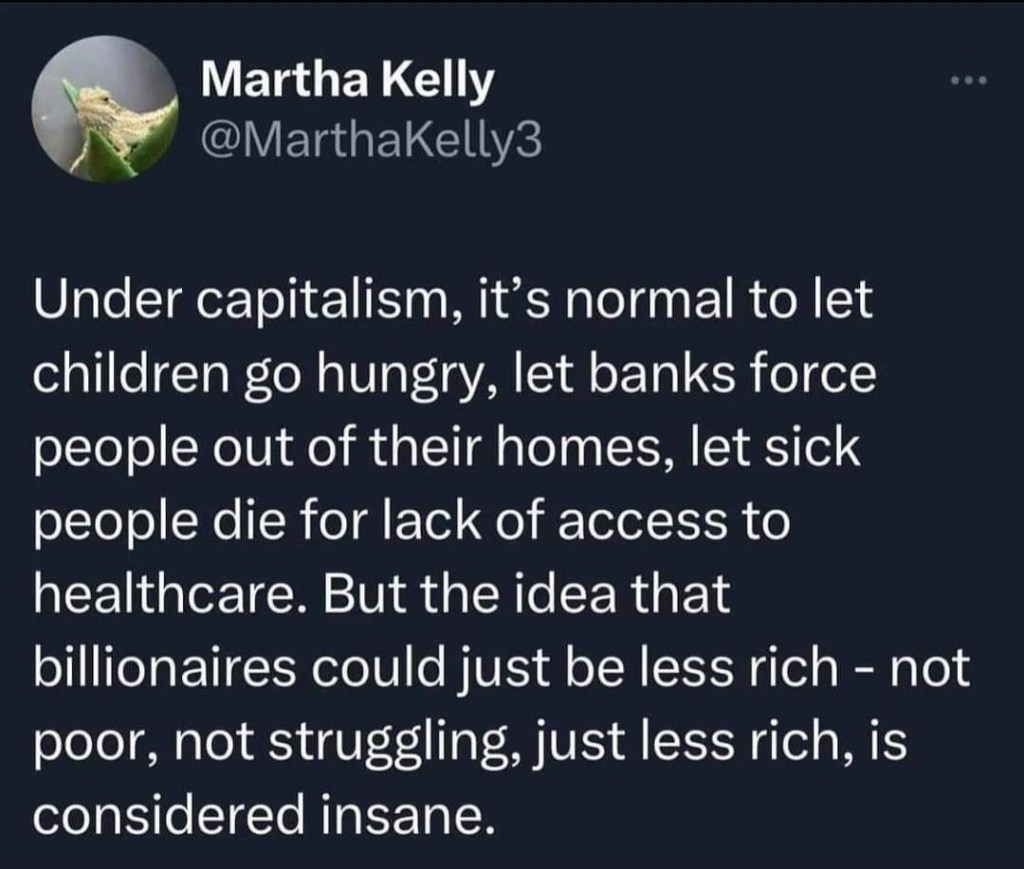

We know from watching what happened after the Tax Cuts and Jobs Act passed in 2018 that when you cut taxes for companies, they post record breaking profits and then distribute those profits to their shareholders through stock buybacks. They don’t hire enough people to end short staffing. They don’t give ordinary workers a raise. Workers have to strike to get decent working conditions, even when they’re working for an industry that has huge profits and could definitely afford to spread that money around to their employees.

Utah had a chance to expand Medicaid eligibility for pregnant women this year. Utah said no. Republican state representative Dr. Ray Ward introduced the language into the bill to make more pregnant women eligible for Medicaid. He said:

“I understand that we cannot provide every bit of health care to every person, and I don’t think we should try to do that,” Ward told KSL-TV in an interview Tuesday. “What things do I think we should provide out there? Coverage in pregnancy is on my list.” Ward, a doctor, argued expanding Medicaid would use existing money, costing taxpayers basically nothing new. [source]

It was another Republican who killed it.

But he (Ward) ran into opposition from Rep. Norm Thurston, R-Provo, who said the state can’t afford it. “I don’t think this is a great year for expanding Medicaid,” he said. “We don’t have a lot of new money.” Thurston added that women can already access health plans through their employers or the Affordable Care Act.

So. Even though expanding Medicaid won’t cost taxpayers, the Utah legislature didn’t want to expand Medicaid to more pregnant women because Utah doesn’t have “a lot of new money” this year. In Utah, Medicaid covers 10% of women of childbearing age. The national coverage average is 21% which puts Utah at less than half the national average. [source – click on Utah to download the fact sheet.]

The reason that Utah doesn’t have “a lot of new money” is because the legislature wants to cut income taxes instead of leaving the income tax rate alone.

Representative Thurston said pregnant women can already access health plans through their employers or through Obamacare. He might be right. 63% of adults in Utah who are on Medicaid are working. [source – click on Utah to download the fact sheet.] That statistic tells me that those employed people on Medicaid are working for less than poverty wages, or their employer-sponsored health plan is abysmal. But sure, tell poor pregnant women to buy health insurance out of pocket.

Now we get to the widow’s mite. You all know the story. Jesus noticed people donating money to the treasury. Rich people donated a lot of money. A poor widow donated two mites, a miniscule amount of money. Jesus said that the widow had donated more than the rich people, because she had donated her entire living. Mark 12:41-44.

Let’s say the widow is pregnant and living in Utah this year. Her husband died in her first trimester. What she really needs is a doctor for herself and the baby. But instead, she’s going to get a tax cut. Utah’s Medicaid eligibility is set at 138% of the Federal Poverty Level. For a single woman, that’s gross income of $20,120 (there are some asset limits too, but let’s keep this simple). This pregnant widow isn’t eligible for Medicaid, so let’s set her gross income at $25,000, which is too high for Medicaid. After the standard deduction of $14,600 for a single person [source], she has $10,400 of taxable income. Utah’s tax cut puts an extra $10 in her pocket.

Behold, the return of the widow’s mite.

The widow gave away “all her living” and it does her no good to have it returned to her. What she really needs is for Medicaid to cover her obstetrician and delivery of her baby.

Society could expand Medicaid to cover her medical care, and I’m willing to bet that most Utah voters want that, both Democrats and Republicans [fn 4].

I would rather pay my taxes and expand Medicaid than get my tax cut. I’m supporting three children and I still feel this way. Even if I want to take my few dozen dollars that I get in an income tax cut and use that to support pregnant women without health insurance (or who have health insurance but can’t afford the co-pays), what am I supposed to do with my tax cut money? How do I find a pregnant woman without health insurance? I don’t know anyone personally.

Say I find her and give her my tax cut money. That might pay the co-pay for one visit and buy her a bottle of vitamins.

Private charity can’t meet the needs of the working poor, or the unemployed poor. I want Utah to keep my income tax money and expand Medicaid. I want that company who nets $5,000,000 yearly to pay enough taxes to make up for the fact that its health insurance plan is crap and half their workers qualify for food stamps and Medicaid. Having a job is no longer a guarantee of having enough money to live comfortably.

Taxes are a way to pool resources and meet needs that can’t otherwise be met. A low-income pregnant woman needs Medicaid, not an income tax cut of $10. Someone netting $5,000,000 in income isn’t going to miss paying $5,000 in taxes. It’s worth noting that even if the millionaire wants to put his tax cut towards paying medical bills for pregnant women, that $5,000 won’t cover her medical expenses. And how is a millionaire going to find a pregnant woman without health insurance?

The widow’s mite is a symbol of suffering. A poor pregnant woman who can’t afford a doctor and can’t qualify for Medicaid is not going to be blessed for her suffering. Instead of giving her back the mite, let’s pool society’s resources and meet her needs.

[fn 1] The Utah State Constitution states that all income tax collected must be spent on education and supporting the disabled. Utah State Constitution Article XIII Section 5(5). All income tax cuts thus reduce funding for education and supporting the disabled. The income tax cut isn’t going to directly impact Medicaid eligibility. I’m using this example for purposes of discussion. The real impact of this tax cut is $167 million less for schools.

Much of Utah’s budget comes from property tax and sales tax. The state sales tax is 4.85% and then cities and counties add on to that. Utah is one of 13 states that still has a sales tax on food. Sales tax is considered a regressive tax, meaning poorer people pay more of it than richer people do. The Utah legislature never cuts the sales tax though, just income tax.

[fn 2] Here’s the math if you want to see how I figured out the tax cuts.

Someone earning taxable income of $100,000 will pay $100 less in taxes.

- $100,000 taxed at 4.65% = $4,650

- $100,000 taxed at 4.55% = $4,550

- $4,650 – $4,550 = $100

Someone earning taxable income of $5,000,000 will pay $5,000 less in taxes.

- $5,000,000 taxed at 4.65% = $232,500

- $5,000,000 taxed at 4.55% = $227,500

- $232,500 – $227,500 = $5,000

And so forth.

[fn 3] Here’s an interesting story about a rich heiress who wants her inherited wealth taxed away. She believes that philanthropy perpetuates wealth inequality and the best way to benefit society is to let the government take her riches and have elected officials decide how to spend it.

[fn 4] The federal government offered funding to the states to expand Medicaid. Utah’s legislature refused the money, and has refused to expand Medicaid at every single opportunity. Voters got so upset that they made Medicaid expansion a ballot initiative AND IT WON. Utah’s legislature ignored it.

—-

Questions:

- Do you think the government should help poor people?

- Are you okay with some of your tax money going to help poor people?

- Do you think the government should cut benefits for poor people?

- Do you think the government should cut taxes instead of helping poor people?

- Do you think private charity should handle most of the poor’s needs?

- Let’s consider another hypothetical about poor peoples’ medical bills. Say Dan is a 45-year-old unemployed alcoholic. He was a crappy husband and father, and his ex-wife and kids want nothing to do with him. He staggers into the street while drunk and gets hit by a car. It was a low-speed impact. He’ll live, but he needs six months of physical therapy. Otherwise, he’ll spend the rest of his life in pain. He doesn’t have health insurance to pay for a prescription either, so his only pain medication will be more alcohol. Dan doesn’t qualify for Medicaid because of the asset limit. He’s got a retirement account that he contributed to before his alcoholism got really bad. Because he feels guilty about being a crappy husband and father, he told his ex-wife she could have the retirement account money for the kids. But the lawyers screwed up and the divorce decree didn’t use the right wording. The retirement account still technically belongs to Dan, but he’s not going to touch the money. Still, he can’t get on Medicaid unless Medicaid is expanded.

- If you had the choice, would you expand Medicaid so Dan can get physical therapy? And maybe treatment for his alcoholism? Why or why not?

Janey I don’t disagree with your sentiment that these folks definitely need to be taken care of, but under “Obamacare”, (which conservatives seem to be so bent out of shape about), she qualifies for ACA subsidies (at that income in 2024 means a $0 deductible and $0 premium plan).

Correct me if I’m wrong, but I’m pretty sure that the Dan scenario would be the same deal.

How do I know all this? Being poor af and having special needs kids requiring a lot of medical care through Obamacare.

Hi Janey, I went to the ACA marketplace and looked up what the widow making $25,000 a year would be eligible for.

The could buy a silver plan for $17/month that had a $250 deductible and and a $3000 dollar out of pocket maximum.

I am being fact-checked! You guys are great. Thanks for looking that up. Okay, so she can’t get Medicaid, but Obamacare helps her out and she can get medical coverage. She can get either a $0 deductible with a $0 premium, or a $17/month premium with a $250 deductible. That’s great news!

So, despite Utah not expanding Medicaid, our poor widow has good options through Obamacare.

Like jpv, my experience with Medicaid and Obamacare came from needing to find health insurance when I was unemployed. I didn’t qualify for Medicaid in Utah because I owned my car without a loan (old car) (seriously, the asset restrictions for Medicaid are tough) and had some money in a retirement account that I was using for living expenses. When I eventually bought an Obamacare policy (maybe in 2012? 2013?), the premiums were a couple hundred per month, even though I was out of work and my only income was child support.

I focused this blog post on Utah’s reluctance to expand Medicaid, and now I am wondering who would have benefited from the Medicaid expansion if a pregnant “working poor” person can get a $0 Obamacare policy. I am very grateful for Obamacare.

I’m more of a tax wonk than a health insurance wonk. I can explain why I don’t think tax cuts help poor people who need health care, but I cannot explain the ins and outs of Medicaid and Obamacare. Anyone else who knows about the interaction between Medicaid and Obamacare and how they help the poorest people is welcome to chime in.

I will then provide an enthusiastic pep talk about how happy I am to pay taxes to support government efforts to provide health care to poor people. Seriously, health care isn’t something that can be addressed by private charity. And poor people suffering because they can’t afford a doctor is something that we can prevent.

I mean this mostly in jest but Moses 7:18 states that:

”And the lord called his people Zion, because they were of one heart and one mind, and dwelt in righteousness; and there was no poor among them.

It sounds like to build Zion we need to eradicate the poor amongst us. Either through uplifting them out of poverty or getting rid of them. Unfortunately, it feels like most government officials seem hellbent on eradication.

We can and should do more.

Utah does have a food sales tax, but it is only 3%. For most food items it should be 0%. This does not materially impact any of your arguments. I drive a Honda Civic. November was the last time I managed to even fit $30 worth of gas in it at a time. I can currently fill it twice for $48. This is likewise totally beside the point. (Number are some of my best friends. I’m a bit unreasonable about how I treat them.)

I’m in Utah, and I’d prefer my tax cut go to helping poor people. I suppose it is on me then to find something charitable to do with 0.1% of my taxable income next tax season (when the changes will actually apply). Private charities do many wonderful things, but they have inherent limits to them, and can stipulate conditions that the public cannot control. If I win the lottery, I can start offering housing vouchers to people, but maybe I want to exclude left-handed people. No one can stop me from doing so. The point of the government providing aid is that we can also have laws and constitutions that limit those exclusions, so aid isn’t available only to those in big cities, or only women, or only right-handers.

As a side note, I believe that there are cases where we spend more money enforcing eligibility requirements for programs that we would “lose” if we didn’t enforce them. If conservatives want to decrease the size of the government, why don’t they get rid of the endless forms required to get government aid. Once while unemployed, we needed health insurance, and I was pretty sure we’d be getting some sort of ACA plan, but before we could do that we had to submit medicaid paperwork, so that could be rejected. And then there is a separate children’s health insurance program and my kids had to apply for that, before they could get ACA healthcare. It took many hours of our time, and many weeks of waiting to sort everything out. There are many instances like this, where we force poor people to pay with their time to receive assistance, and employ a great many low to moderate wage office workers are employed running that system.

This discussion makes me wonder about the financial impact of tithing upon the poor.

jc: Wonder no more! Tithing is a flat tax, therefore it is regressive, hurting the poor

jc, Angela: I believe that tithing is mis-taught by the leaders who speak on this subject (usually 70s and local) and is mis-understood by many (most) members. Tithing is not 10% of gross, nor is it 10% of net. A shepherd’s increase in sheep was looked at one year over the next. His ewes may have birthed 200 lambs, but he didn’t tithe 20 lambs. Out of those 200 lambs, some were eaten by wolves, some were traded for other commodities, and some were eaten. Some might have been provided for a daughter’s dowry, or were stolen by thieves. To tithe on the gross, or revenue, line, is not what the Lord has ever asked.

Using language from not long ago, and certainly language current at the turn of the 20th century and for many decades after that, before most men were on the payroll, income was a business term, and it had a specific meaning. Income was not revenue. Income was revenue less necessary expenses. So income by definition is closer to net than to gross. Not all expenses were considered necessary for this definition: taxes on income (but not taxes on cost of goods purchased or property taxes), capital improvements and investments, dividends, etc. Necessary expenses did include the cost of goods purchased to manufacture or produce goods for sale, including raw materials, as well as any taxes or transport on those goods, as well as workers’ salaries, utilities, mortgage, etc. For people like Heber J Grant, income had a very particular definition, and it was not equal to revenue.

I would rather have more members of the church paying on some sort of net basis, and getting temple recommends, than not paying on gross because they can’t afford it, and not having a temple recommend. I would be willing to trade some tithing dollars for more temple recommend holders, and I don’t think that would be cheating the Lord. My net–the amount that I actually touch–per my pay stub, is about 56% of my gross. I could argue that my revenue line isn’t my gross—my gross is what actually lands in my bank via electronic deposit. I pay on the that basis, so maybe I do pay on the gross. To pay on my revenue line, the top amount on my pay stub, I would pay 18% of my take-home pay, before mortgage, utilities, food, etc. I don’t think that the Lord demands 18% of everything that I touch, before food, housing, etc. Remember, the shepherd doesn’t tithe on every lamb born to his ewes, nor can the farmer tithe on everything that his fields produce. A lot of the farmer’s yield goes to the birds and snakes (like taxes), but birds and snakes eat mice and rodents.

I would like to see the leaders clarify to the people that it is improper to teach wage earners that the proper tithe is on the gross, the top revenue line. People can certainly choose to pay on that amount, and I used to, but I couldn’t keep up—and it isn’t because I lacked faith. I would teach what the First Presidency put in a letter to stake presidents and bishops in 1972, and which was printed in the Ensign in April 1974, that each member is free to determine what tithing he should pay, and then should pay it according to his conviction. The church might lose some tax dollars, but I think that the number of full tithe payers would increase. We also teach in error (my opinion) that one should pay tithing before buying food for the children, and that one must pay immediately, so a worker paid weekly would make 52 donations in a year. Tithing is figured annually, after expenses, and some necessary expenses are surprises, such as medical costs not covered by insurance or repair costs for the heater that went out in the winter. I think that every member should be free to determine what his tithing should be, to pay that amount, and then to inform the bishop that he has paid a full tithe, with no explanations.

Sorry for the length, but I am headed out and it was either post it long or not post, so apologies for not making it shorter.

Utah has refused to expand Medicaid because of bizarre lingering antipathy toward government healthcare coverage on the part of the right wing. Probably a carryover sentiment from the Cold War days. In the states that have refused Medicaid expansion here are some findings by the Robert Wood Johnson Foundation about what would happen if they did accept the expansion:

The rate of uninsured would have dropped 25% had these states accepted the Medicaid, with a 31% decrease for women of childbearing age, a 51% decrease for black women, and a 43% decrease for black adults, and a 32 percent decrease for young adults 19-24. The states that have accepted Medicaid expansion have saved on overall healthcare expenditures and in new revenue.

Bear in mind that in the US, healthcare expenditures per capita in 2022 were $12,555, with Switzerland a distant second at $8,049. The average for OECD countries is $6,651. It makes more sense for the government to expand more greatly into healthcare, and well beyond Obamacare. I think that the government should mostly take over healthcare services with a modestly sized private alternative still available for those who want quicker, possibly better service. It would be cheaper for about everyone, drastically help the poor and lower-middle classes, and overall healthcare quality wouldn’t be impacted that much. I remember my uber right-wing brother-in-law gawking at how in Italy the waits for seeing a doctor were absurd and how poor the healthcare system was because it was government-run. Meanwhile, Italy has a life expectancy of 82 while the US is at 77.

It truly boggles my mind how the people in the US who most greatly claim to follow Jesus are the ones who routinely blame the poor for their poverty, refuse to help them through government services, and want tax-cuts for the wealthy, never wanting to raise them ever. Their belief system is about the opposite of what Jesus taught.

Georgis: true but not what is currently taught. Disingenuously I might add

Georgis,

“I think that every member should be free to determine what his tithing should be, to pay that amount, and then to inform the bishop that he has paid a full tithe, with no explanations.”

Definitely sounds reasonable compared to the current procedure. I would go a step further and abolish annual in-person tithing reports to the bishopric and do away with the temple recommend. The church literally does not need tithing to function. There is no financial point in enforcement mechanisms. They are only there to maintain tradition and keep the membership in line.

I get a lot of my information from the Salt Lake Tribune. In my understanding, there was an unintended quirk in the ACA bill that passed. The quirk left a swath of people who earned too much to qualify for Medicaid, but somehow didn’t earn enough to qualify for the ACA.

Utah, and several other like-minded states, refused to accept millions of federal dollars to expand Medicaid to this group of people. It would have cost us Pennie’s on the dollar.

For several years running, there were people with cancer, or other illnesses who could no longer work who testified to the Utah legislature about their deadly predicament. Our legislators kept refusing to pass the needed legislation.

The referendum did pass, and if I recall correctly, the affected people did get Medicaid funding.

The SLTrib reported on those who died of their illnesses during the wait.

Dave W – I neglected to mention that Utah’s sales tax on food is 3%. Thank you for pointing that out. My gas tank is much bigger than your gas tank, and I’m always happy when I can fill it for less than $50.

I’m glad you brought up means testing too. “Means testing” is when a charity makes you qualify for help. If you have the “means” to provide for yourself, then you can’t get help from Medicaid or the charity. It makes sense. You don’t want Medicaid money going to someone who doesn’t need it. Passing the ‘means test’ involves a lot of red tape. Probably, some people who would qualify don’t get the benefits because they can’t get past the red tape. I was nearly defeated by the red tape when I was applying for Medicaid. It takes a lot of time and effort to claim government help. It’s a tricky issue. It’s expensive to pay salaries to people who screen applicants, and it’s expensive to not pay salaries to people who screen applicants because of the risk of scammers.

Brad D – yeah, I don’t understand the dislike about government provided health care. My friends who watch Fox News have been convinced that socialized medicine would be a disaster. They’ve heard the stories about long waits and substandard care, and people coming to the USA for medical care from countries with socialized medicine. I tried to respond once with stories of Americans going to Mexico for medical care but that didn’t go over well. I’m not actually a socialist hoping for single payer healthcare. Health insurance through jobs catches most people; I would want the social safety net expanded to catch people who can’t work or who can’t work full time.

Sasso – You’re right. There was tons of support from the voters to expand Medicaid in Utah, and yet the legislature refused. So frustrating.

from the April 1974 Ensign in an article by the Presiding Bishop of the Church:

On March 19, 1970, the First Presidency sent the following letter to presidents of stakes and missions, bishops of wards, and presidents of branches in answer to the question, “What is a proper tithe?”

For your guidance in this matter, please be advised that we have uniformly replied that the simplest statement we know of is that statement of the Lord himself that the members of the Church should pay one-tenth of all their interest annually, which is understood to mean income. No one is justified in making any other statement than this. We feel that every member of the Church should be entitled to make his own decision as to what he thinks he owes the Lord, and to make payment accordingly.

At the close of each year, each member of the Church has the responsibility of attending tithing settlement with his bishop. At this time, each member has the opportunity to declare whether he is a full, part, or non-tithe payer. The payment of tithing is a matter between the individual and the Lord. The bishop is merely the Lord’s servant who receives and accounts for the contribution.

As Georgis pointed out above, there may be error in conflating income with revenue.

[the emphasis (bold) is mine]

The wealthiest corporation in Utah is exempt from paying taxes.

In 1985 Utah became a Super Majority state with a Republican majority in the House, Senate, and in the Governor’s Office. Utah ranked in expenditures per student either last in the nation or just above Mississippi but shortly thereafter settled into the bottom where it stayed until 2023 or so when Idaho and Arizona sunk to the bottom (two other super majority Republican States.) Of course during these past 40 years or so there were either excuses like we have larger families, or a lot of our land is federal land which don’t pay taxes or we pay a higher percentage of our budget for education. But over the years, our families are smaller, the federal lands argument falls flat because we still have more private land than and less population that 4 or 5 other states, and where our state budget for education used to be half the budget, it is now closer to a fourth. This last year it was an 8 billion dollar education budget out of a 29 billion budget.

So the excuses were just that and masked what I think is that Republicans just don’t want a strong public education system. Education has been funded by a combination of property taxes and all of the income tax. This is part of the constitutionally mandated responsibility for the legislature to provide local public schools. The state income tax was specifically mandated to go to public schools. So what has happened in the past forty years? Where income tax was graduated, it is now a flat tax which this year was set at 4.55%. Going from a graduated to a flat tax cost schools between 1-2 billion a year since 2016 when the law was passed. Originally the flat rate was 5% so the cuts to 4.55% has cost an additional billion. Also originally the income tax was for public schools but a law was passed that allowed it to be spent on high education so a half billion was lost to public schools. Add all these changes up over the years and you can see that Utah could be spending at the national average per student instead of being at the bottom of the nation. What would this mean? We might not have the highest number of students in the classroom in the nation, we might have nurses for every schools, we could have more school counselors, better arts programs, and the list could go on and on resulting in a better education system with better results.

Sales tax goes into the general fund as do most other taxes. Sales taxes are regressive in nature, meaning the poor have a larger burden for the tax. In other words more of a poor person’s income goes to the tax than someone that is richer. With sales tax you can only buy so much and when you’re rich, many of the things you might purchase, don’t have sales tax.

The bottom line though is what do we use taxes for. Many people think all taxes are wasted but in reality it’s for things that we all need and can do better when we put our money together. Things like roads, schools, parks, police protection, fire protection, and regulating society so the most powerful or the bullies don’t take advantage of the less fortunate. We could use taxes for better health care which would reduce the burden on individuals but also on businesses who have to carry health insurance for their employees. There is so much money being spent in health care though that moving the USA to be inline with other countries healthcare expenditures would cost hundreds of billions of dollars for insurance companies and healthcare organizations which none of them would give up easily for the betterment of society.

So what’s happening with our taxes. The rich are paying less. We are spending less on public responsibilities and shifting them to private enterprises so the workers don’t get as much but the owners make huge profits. It could be with charter schools where the teacher or even administrator doesn’t make near what the owner of the charter school company makes. It could also be with healthcare where city and county hospitals have either merged into large healthcare organization or one out of business. Doctors who used to independent contractors now have to align with the healthcare organizations who take care of the buildings and staffs but also give a salary which is many times lower that the CEO. The privatization of services which is supposed to save tax dollars actually enriches a few company owners, lowers quality, lowers wages for most workers, and does a worse job that workers who are charged with a specific responsibility to take care of for the pubic.

The supermajority hasn’t improved things for most of us but they have eroded trust in government. They have enriched a group of people with tax dollars. They have shifted the burden of governance more to the poor and middle class giving the rich a bigger and bigger financial break. And, as we’ve seen in this past session, have isolated themselves from transparency and accountability by making it so you can’t even look at their calendars or making it harder to mount a voter referendum as just a couple of examples.

One really big problem with a flat tax and tax cuts for wealthy folks & corporations is that it hollows out the middle class. A healthy economy has a robust middle class.

In what many consider to be the halcyon days – the 50s, the top marginal tax rate was 90%. Meaning, I believe, that taxes increased with increasing tiers of income. Imagine, if you will, that during the pandemic, the top marginal tax rate was 90%. Would Jeff Bezos still have gotten richer, duh YES. Would government coffers have been able to cover the needed but costly government programs that helped so many people stay afloat? Yes again.

It is disingenuous when politicians sow worry about the national debt, while cutting taxes.

Instereo—great analysis and explanation. For too long Utah politicians have used the excuse of lack of money to fund the public schools in the state yet Utah is a wealthy state and if the wealthiest residents paid their fair share of taxes there would be enough and to spare, to quote D&C 104 and Luke 15.

Good point about a middle class, Tallman, along with your point about politicians who cry alarm about the debt while they decrease taxes for billionaires.