I was recently doing some research on a side project and, in the course of that research, ran across some data regarding incomes within the United States over time. What I found was pretty disturbing.

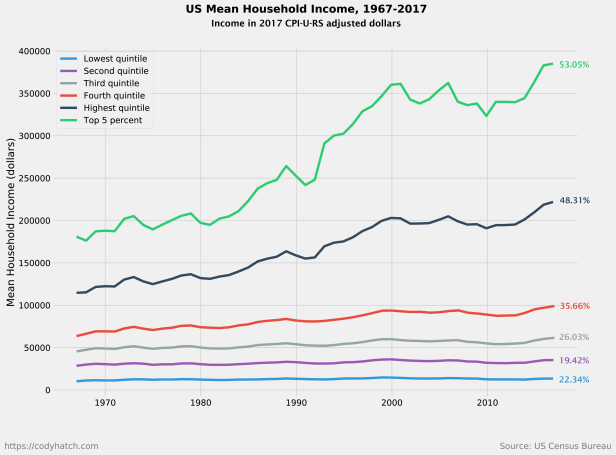

The above graph shows US mean household income, in 2017 CPI adjusted dollars, from 1967 to 2017. It is broken into quintiles and includes the top five percent of earners for comparison. I’ve also added the percentage growth for each line during the 50-year timespan.

I also calculated the ratio of “top five percent”-to-“lowest quintile” for 1967 and 2017.

- 1967: 17.5/1

- 2017: 29.0/1

While God mentioned that we will always have the poor with us, I don’t think he intended for us to make efforts that ensure it remains the case, so I’ve got several questions:

- What are the societal implications of an increasingly large income disparity?

- What can we do to ensure our nation doesn’t become a place of haves and have-nots?

- What does our Christian faith ask of us in this situation?

- How do we view this income disparity in the context of Doctrine and Covenants 49:19-20: “For, behold, the beasts of the field and the fowls of the air, and that which cometh of the earth, is ordained for the use of man for food and for raiment, and that he might have in abundance. But it is not given that one man should possess that which is above another, wherefore the world lieth in sin.”

Good questions!

There are also these verses found in Section 78 of the D&C:

5 That you may be equal in the bonds of heavenly things, yea, and earthly things also, for the obtaining of heavenly things.

6 For if ye are not equal in earthly things ye cannot be aequal in obtaining heavenly things;

Cody, if this news surprised or interested you, I challenge you to:

– like/follow Bernie Sanders FB page for even a month. Regardless of your politics- read about how people are reacting to this information as this movement displays this and similar graphs frequently. The corruption involved in areas of politics, banking, tax law, come into the picture and issues such as access to education, healthcare, community resources, infrastructure, etc. all arise as key issues in this conversation.

– Watch the movie “Flint” which details this phenomenon through a city that due to its homogeneity and place in the fall of the American car industry, epitomized how this trend affects a community. It’s somewhat old, but has resurfaced in the news as Flint and Michigan played a key role in the recent election and continue to struggle with the ongoing tap water crisis. (Michael Moore is a divisive guy- I get that- but the movie was one of his earlier works that documented his hometown. If you step back from politics- this is a guy lamenting what happened to his home and community. He warns that Flint is something of a canary in a mine and an early warning about the consequences of income disparity.)

Take it or leave it, but at least plug into the conversation. This isn’t to many people- news.

I don’t want to thread-jack your post with political ranting and am not advocating for any party- just saying that if this was news to you- I would encourage you to plug into this huge movement.

Notice, every group had at least a 20% increase in income. How do we keep that going?

(Since most of my relatives and many friends are in the lower groups.)

Is the incentive for the top increasing their income by >50% connected to the bottom increasing by 20% ? Or is closer to an equal distribution even possible? How have different economic systems in real history across the globe in the last few centuries accomplished these goals? What is the long view?

Deep historical economic progress is cyclic. Empires rise and fall. The Roman empire fell. Chinese history is a series of dynasties that rise and fall. The Renaissance and the Industrial revolution and now the digital revolution created great wealth and progress. But the Word Wars of the 20the century were apocalyptic for many people. Nuclear war is going to be very difficult to avoid long-term.

Previously, the plague killed off 2/3rd of the population in Europe.. The Toba volcano eruption in Sumatra 75,000 years ago caused a global winter for decades and pushed the human population down to around 1000. Controversial how low and the role of other factors .But the fact remains that something (or things) destroyed most of us living at that time.

Oh, you say, that won’t happen to us. Ridiculous! Call me a crank. The sky is falling, said chicken little.

Probably not the volcano. Less severe catastrophic events are more common. Everything is changing faster and faster. We are more specialized and demanding; less and less flexible and adaptable to entirely new situations. Our technology is increasingly powerful and potentially destructive. Our level of moral functioning and integrity is largely in the toilet, especially among the most powerful of us. We are changing the environment in fundamental and unsustainable ways. Our social institutes for raising our young are in shreds. We have never been so ripe for destruction.

“For ye have the poor always with you. But me ye have not always.”

These words recorded in the New Testament (Matt 26:11) and attributed to Jesus.

Do we invite Jesus to be with us? This life is a time of suffering, individually and as communities and nations. The next for rejoicing. Any happiness we wrestle from historical and social entropy in this vale of tears is cause for gratitude and celebration; 20% average increase in income of the poorest amongst us over half a century is a rare event in history.

@Mortimer: I’ve followed Bernie Sanders and the movement on that side of the political spectrum so this wasn’t news to me. It’s just always a bit disturbing to see the raw data and explore it a bit. I’m also kind of a skeptic when it comes to the claims of any political movement, so I have to dig into the data myself to feel like I can start to really understand what’s going on.

And don’t sweat a political rant. This was a political post. 🙂

@Lois: Those verses of D&C are very appropriate to this situation. Thank you.

I don’t know what we as a church can do about this, except to keep the “corporate” model of church financing that allows the wealthier areas to build chapels and fund programs in other areas. I also think the Church could shift some focus to “caring for the poor and needy” part of its mission through the missionary program (more focus on service missions, more service in proselytizing missions).

From a political perspective, we need to get over the idea that estate and inheritance taxes are somehow unjust. I’m a dyed in the wool capitalist who believes low taxes spur innovation and growth, but none of that applies once you’re dead, and your kids aren’t entitled to vast fortunes based on your hard work/innovation/luck. If we limited everyone’s starting point (even if that limit allows people to inherit some level of comfort), then people would know they can work and succeed, but we limit the ability to build an aristocracy.

Dsc

Interesting perspective on estate/inheritance taxes. So your thought would be that the government is more entitled to my vast fortune based on my hard work/innovation/luck than my own children?

Ojiisan-making Dsc’s argument for him here, but the civil state and it’s maintenance of society has made it possible for you to prosper. Payback maybe. I’m assuming it would have educated your employee’s at least.

What are the societal implications of an increasingly large income disparity?

A gradual drift toward feudalism is either a cause of this, or a consequence (or both). I think the cart is before the horse. Income disparity is not itself a problem.

Explain: If you imagine that there’s a certain size of pie, and if someone takes more than his share, as you suppose his share ought to be, then there is that much less for you. However, if the pie doesn’t actually exist but hands out money on demand, then you can have as much as you like, particularly if you invented the system in the first place (Rockefellers, etc).

Quite a few wealthy persons don’t have “income” in the usual sense.

“What can we do to ensure our nation doesn’t become a place of haves and have-nots?”

Too late for that. Communists have some good ideas implemented by bad people. The usual recommendation is not to allow personal property. In such cases society as a whole devolves to barely above stone age.

“What does our Christian faith ask of us in this situation?”

There is no “our”.

My understanding is exemplified by the parable of the Good Samaritan. He took it upon himself to assist one stranger. Maybe another one after that, it doesn’t say.

There is no mandate to compel Caesar to render unto Romans or Christians. Saints are permitted to pay taxes and Mormons in particular are expected to obey the laws of the land. Government charity is not Christianity and it does not relieve a Christian from a duty to personal charity.

“How do we view this income disparity in the context of Doctrine and Covenants 49:19-20: For, behold, the beasts of the field and the fowls of the air, and that which cometh of the earth, is ordained for the use of man for food and for raiment, and that he might have in abundance. But it is not given that one man should possess that which is above another, wherefore the world lieth in sin.”

Obviously the world lieth in sin. Let us balance your quotation with the flip side of the coin. D&C 42:42 Thou shalt not be idle; for he that is idle shall not eat the bread nor wear the garments of the laborer.

Let us also consider the Parable of the Talents: One person had one talent, another had two, and the third had 5. The 2 became 4, the 5 became 10, and they were approved.

We were not equal in heaven and there’s no mandate to be equal NOW. I accept that a duty exists to take what I was given and magnify it. Some are given more, some are given less.

As Gandalf says, what matters is what you do with what you’ve got.

Handlewithcare asserts “the civil state and it’s maintenance of society has made it possible for you to prosper.”

Or as Obama says, “you didn’t build that”

Even if you did.

Handlewithcare

I’m not certain that it is a given that it is the civil state and the maintenance of society that would have enabled me to amass my fortune. Arguably with the right skill set I could acquire a greater fortune without the shackles of the civil state. However, that is a bit of thread jack that is probably not worth pursuing at this point. The difficulty with the concept of taking from those who have more is the problematic assumption that it will necessarily make its way down to those in the lowest or second lowest quintile. Generally the money the government takes makes its way into a government program and the majority of the funds goes into administering the programs and is of little benefit in actually increasing the income of those in the lowest or second lowest quintile. Interestingly enough many charities suffer from similar issues and a significant portion of the money collected goes into administering the collection and disbursement process and does not make its way to those it is intended to assist. That is one reason why contributing to the the church fast offering and other assistance funds is productive: most of the money goes directly to those in need.

Ojiisan,

Here’s how I look at it: No person is entitled to the fruits of another’s labor. Taxes are a burden on people and are inherently unfair unless you could somehow calculate one person’s precise benefit from government and charge them for it (we try to do that with fees and assessments, but the government does much of what it does precisely because an individual’s benefit is too hard to determine). However, governments provide services that are necessary for an ordered and prosperous society, so we have to submit to the admittedly unfair process of taxation. As taxes increase the cost of things, it is important to avoid artificially increasing the cost of things that benefit the public wherever possible. Income taxes discourage earning the next dollar, and so are not the best way to tax. Sales taxes discourage spending, which benefits the economy. Property taxes discourage property ownership, especially by those who will not use the property to earn more money and risk taxing old ladies out of the home’s they have lived in for the better part of a century. Estate and inheritance taxes, on the other hand, don’t discourage behavior that is beneficial to society. A person can earn money and enjoy it their entire life, and never personally feel the pain of an estate tax, and so it has a minimal effect in changing behavior. As I stated in the beginning, no person is entitled to the fruits of another’s labor, so while it would be nice to pass on wealth to children, they are not entitled to it. A system where wealth is taxed upon death would allow those children to earn their own wealth and enjoy the fruits of their own labor. Of course, a smart estate or inheritance tax would allow people to pass along substantial wealth upon death, but would prevent the creation of dynasties or an aristocracy, which slows overall wealth growth for everyone else.

Dsc cites one of the CtP’s (communist talking point) forbidding inheritance: “your kids aren’t entitled to vast fortunes based on your hard work/innovation/luck.”

Sounds a LOT like the parable of the Little Red Hen. She works, bakes a cake, nobody helps. Only when the cake is ready to eat suddenly all the other animals are there to help eat it.

Obama would say she didn’t bake that cake and yes, all the other animals are entitled to eat that cake that society baked.

A more correct understanding is that the builders of the oven she used to bake the cake has already been compensated, The makers of steel that went into the sheet metal that went into the oven that baked the cake have already been compensated! The roads over which the materials were transported were paid for by gasoline taxes and were thus already compensated.

No further compensation is due!

So what should the church do?

Answer: Teach the parable of the Good Samaritan.

Charity is a personal duty. Still, I know the church does help some people some of the time as an institution; but it isn’t usually just handouts. People receiving assistance are encouraged to work at something; I also have worked at church owned farms, canneries, the cheese factory in Salt Lake City for and on behalf of people that I will never know or meet.

Dsc, while I tend to agree with your analysis of the consequence of the estate taxes, I am reminded of the destruction of family farms that results. Land rich; cash poor. The consequence of the estate taxes are corporate farms because corporations do not die. Some fine-tuning would make it a lot more agreeable.

My boss intends to start a dynasty, knowing it may last only one generation. He has set up trusts for his children. When he dies there won’t be much of an “inheritance”, the children already have it. You cannot beat the wealthy at their own game!

I suppose a rich man that is foolish, kept it all in liquid assets and all to himself, that fortune can probably be taxed within an inch of its life for all I care and probably won’t trigger economic consequences. After all, his wealth is already out of circulation.

There have been inventors throughout history free to pursue things because they did not have to work a 60 hour week just to live. I suppose these examples may be rare; one that comes to mind is Marconi, widely recognized as inventor of radio: https://en.wikipedia.org/wiki/Guglielmo_Marconi

Obviously not the sole inventor but because of his aristocracy, he had the time and resources to pursue a hobby.

As a different kind of example, Albert Einstein. https://en.wikipedia.org/wiki/Albert_Einstein

He was not rich neither his parents; but well enough off to get him to secondary school. This is a situation where society can and ought, for its own sake, to have some willingness and ability to advance the training of bright young people; to be the “patron” for such persons.

With the current political climate being aimed at the lowest common denominator, social funds are expended to breed equality rather than excellence.

Dsc:

“As I stated in the beginning, no person is entitled to the fruits of another’s labor, so while it would be nice to pass on wealth to children, they are not entitled to it.”,

I would agree that my children may not necessarily be entitled to it but if the government takes my money to re-distribute to third parties then the implicit assumption would seem to be that the third parties are entitled to it which would seem to inconsistent with your view that “no person is entitled to the fruits of another’s labor”.

While no individual may be entitled to the fruits of my labor that would not necessarily obviate my right to decide who should get the fruits of my labor.

Also, estate/inheritance tax doesn’t only apply where I leave it to my kids. It would apply equally if I decided to leave it to someone in the lowest quintile.

Having said all that, you have an interesting argument that, despite its shortcomings, an estate/inheritance tax may be the most effective way to effect taxation.

In the Terrestrial kingdom all are if the same glory. They are all equal. If you love the things of this world then that is what you receive, the Telestial kingdom – like this world.

The goal is to trust in God and other saints, not in riches. Amassing wealth shows a trust in riches. Trusting and having wealth are linked in parallel by Jesus.

The great blessing of heaven are forfeit if we love riches more than the things of God.

Use whatever name or philosophical baloney, blame the poor, blame the church, blame society, in the end the love of riches is simply the love of riches. There is no way to justify it and those who love money are not even fit for the Terrestrial kingdom.

The original post was about income, many of the follow up comments are about wealth.

It should be possible to make the income of the highest paid be no more than 20 time the income of the lowest paid. This would give incentive to increase the minimum wage, or introduce a living wage. At present in US it is 300 times higher, but 100 in Australia, and less in scandinavian countries.

The taxation system allows options for the wealthy to minimise their taxation. Removing these makes for greater equality.

I own property, which produced more income than I made as a wage earner. Did I earn that income? In Australia nearly half the people who take home $1 million pay no tax or no more than the average earner. I don’t believe people on higher incomes work harder than those on lesser incomes, some of the benifit is traditional education, some is other opportunity, or access to finance, or some other knowledge.

I believe that no one should be paid more than 20 times the least. If there were a living / minimum wage of $30000, does anyone really need more than $600,000 a year?

Disparity in WEALTH is greatly reduced if incomes can be controlled. Perhaps the wealth tax above? I intend spending my wealth before I go.

There are countries where there is agreement that they pay higher taxes to have a more equitable society. Where they agree to supplement the income of the poor, so there aren’t poor, just less wealthy. That would be my ideal / zion society.

Current wage & bonus systems don’t help the situation either, where wage rises are a percentage of current salary (and whilst ratios remain unchanged, the absolute gap will widen), and where bonuses are not only a percentage of current salary, but most often a higher percentage for those already on the higher salary (widening the gap in both ratio and absolute terms). Inequities can only increase under that kind of system.

Ojiisan writes “f the government takes my money to re-distribute to third parties then the implicit assumption would seem to be that the third parties are entitled to it which would seem to inconsistent with your view that no person is entitled to the fruits of another’s labor.”

For years (decades) I have tried to understand the redistributionist mind, for implicit in these arguments is exactly that belief that others, through no fault or merit of their own, are indeed entitled to the fruit of your labor, or my labor. or that “labor” is what produces fruit.

See Labor Theory of Value: https://en.wikipedia.org/wiki/Labor_theory_of_value

Geoff-Aus believes the person with the most income should have no more than 20 times that of the least. Why is it 20? Seems arbitrary.

There’s an easy and libertarian way to deprive the wealthy of their wealth: Don’t buy their stuff or watch their movies or rent their houses and apartments or buy their automobiles.

When you watched “Avatar”, you put money in James Cameron’s pocket and he’s already got 300 million dollars from people buying tickets to see “Avatar”. Nobody forced to you buy that ticket. You *chose* to buy that ticket, you chose to enrich James Cameron even though that’s not probably what was on your mind at the time.

Geoff-Aus writes “I don’t believe people on higher incomes work harder than those on lesser incomes”

Obviously they work smarter.

I am fascinated by the 2 to 12 downvote on the parable of the Little Red Hen. I would like to see explanations for those downvotes.

Michael 2, there’s nothing obvious that people with higher incomes working “smarter” than those on lower incomes. Plenty of smart, intelligent people gets less than those at the top–and do a smarter job at what they do. Please don’t cough up that garbage here.

Brian writes “there’s nothing obvious that people with higher incomes working smarter than those on lower incomes.”

Thank you for replying at at least trying to answer some of my comment.

I recommend a review of Adam Smith. It is smart to make nails using a machine since many nails can be made per hour, rather than one or two per hour by hand One of these approaches is smarter than the other. It benefits society because now everyone can have good, cheap nails and thus reduce the cost of houses and other goods made with nails. The nail-maker is also benefited since his income will be multiplied by as many nails as he can make.

“Plenty of smart, intelligent people gets less than those at the top–and do a smarter job at what they do.”

Then they have chosen that outcome. Smart people obtain that which they seek. I do not seek wealth although a little bit more than I have right now would be nice.

“Please don’t cough up that garbage here.”

What is garbage? The Little Red Hen? Explain your thinking. I explain my thinking. I have studied micro and macro economics. Human nature. Wars and the operations of things. It is not clear that forcibly changing “incomes” will, by itself, accomplish much and probably invoke the law of unintended consequences.

Example: Excise luxury taxes in New England practically wiped out the yacht business. As a result, boat workers were unemployed, the revenue from that excise tax was minimal and all those unemployed workers were also not paying taxes. Driven by envy of the rich but punished the middle class. Be careful what you do out of envy. I am not making this story up, you can read it on the NYT:

So, focus on the problem, not just the symptom. Income inequality is a symptom; it can also be a problem as part of a cycle, but to address only a symptom simply moves the incidence of the problem to something else.

So far I see a lot of attention on “the rich”, of which there be few, while ignoring “the poor” of which there be billions. Why is this? I have a doubt about your sincerity with regard to “the poor”. Your eyes are on the wealthy; but not the people, the money itself. Tax it, give it to someone else — doesn’t matter WHO just tax it. Jesus seems to have recognized the bottomless pit called “the poor” because there’s no definition of it and it re-creates itself spontaneously.

Suppose you could somehow feed and shelter 6 billion people right now. What will happen? Well in a few years now it is 12 billion people with their hands out. Can you feed 12 billion people? Probably not. So now you have 12 billion poor people when before you had 6 billion people wth at least enough.

Michael, I’ve read Adam Smith. I’m not ignorant. Citing a point of his doesn’t convince me of your credibility, nor am I persuaded by his arguments. There’s more to economics, as you know, that his ideas.

“Smart people obtain that which they seek” is garbage. There’s more to success than that, and you know it. It’s really difficult to continue to engage with you when you are so blind to how the world operates. Then, to claim that you doubt my sincerity in regards to the poor? We’ll, you can take that doubt and be judged by it judgement day–you know nothing of what I do in this regard.

Economics and the world is complicated. Much more than you suggest, even though you claim to understand that it is.

Quite frankly, your arrogance makes it nearly impossible to engage with you. I get it. I agree with some of your comments, but your attitude is more about being right than good. And I’m not interested in it.

Mike 2, (and Dsc) thanks for your efforts to try to make this less of an echo chamber.

Level playing fields would be a good start. To laws benefit the wealthy/ high earners more then the poor.

Inheritance taxes are a different issue when transferring hard assets like the family farm. It is troublesome when the asset must be sold to pay the tax.